Introduction to Brians Club Business Credit

Navigating the world of business credit can be daunting, especially for newcomers. However, with the right tools and strategies, you can set your business up for success. Enter Brians Club—a game-changer in building your business credibility.

Whether you’re starting from scratch or looking to enhance your existing profile, Brians Club offers a structured approach to establishing solid business credit. Understanding how to leverage personal loans effectively is crucial in this journey.

Let’s explore how Briansclub.ga can empower entrepreneurs like you to build robust business credit step-by-step, ensuring that financial opportunities come knocking at your door when you need them most. Ready? Let’s dive in!

Why Brians Club Business Credit Important?

Building business credit is essential for any entrepreneur. Brians Club provides a unique platform to streamline this process.

Good business credit opens doors. It allows access to larger loans, better interest rates, and favorable payment terms. This flexibility can be crucial as your business grows.

Additionally, strong credit enhances credibility. Suppliers and partners view businesses with solid credit histories as reliable and trustworthy. This perception can lead to stronger relationships in the marketplace.

Using Brians Club enables efficient management of your financial resources. With their tools and guidance, you can navigate the complexities of establishing and maintaining excellent business credit more effectively than ever before.

Moreover, having robust business credit separates your personal finances from those of your company. This distinction protects your assets while allowing for growth opportunities without risking personal funds.

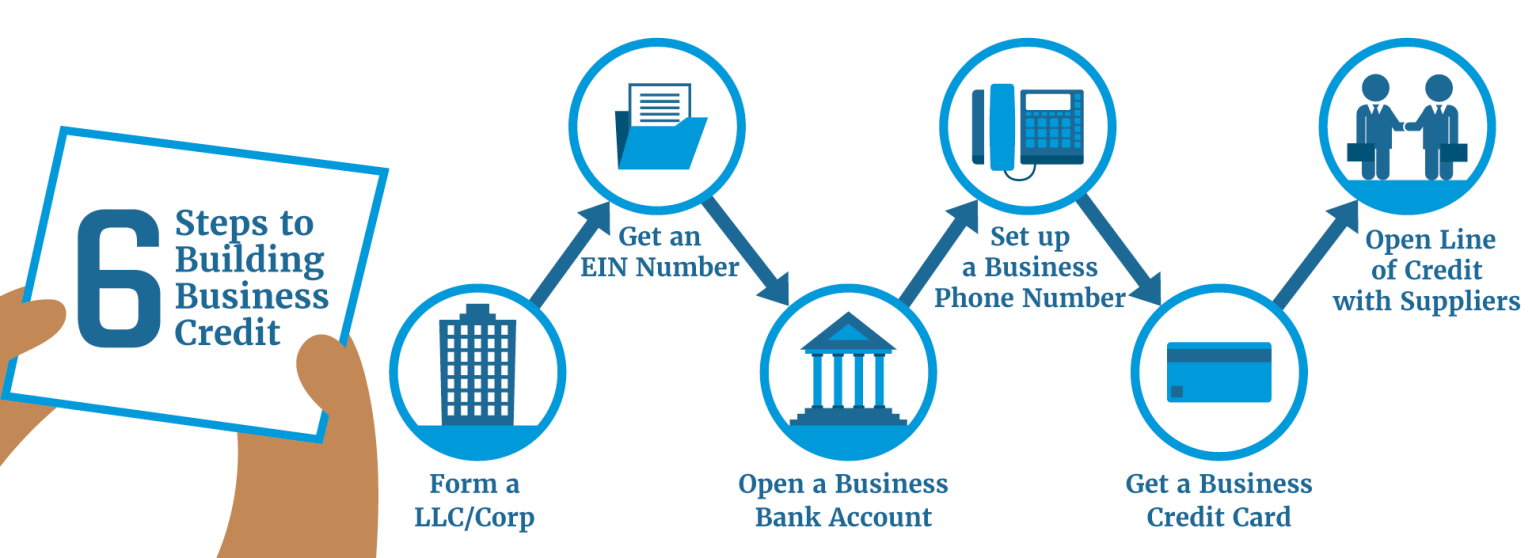

Step 1: Brians Club Establishing a Separate Legal Entity

Establishing a separate legal entity is crucial for any business, and Brians Club emphasizes this step. It’s about creating a shield between personal and business finances. This separation can protect your personal assets from potential liabilities.

Choosing the right structure—LLC, corporation, or partnership—will have significant implications on taxes and liability. Each option has its own set of rules and benefits. An LLC often provides flexibility while offering protection against debts incurred by the business.

Registering your entity with state authorities formalizes your venture. This registration not only boosts credibility but also lays the groundwork for building credit later on.

Once you’ve established this legal identity, it becomes easier to open bank accounts or apply for financing under the company name rather than yours personally.

Step 2: Brians Club Obtaining an EIN (Employer Identification Number)

Obtaining an Employer Identification Number (EIN) is a crucial step in building your business credit with Brians Club. This unique nine-digit number acts like a Social Security number for your business, allowing the IRS to identify it for tax purposes.

The application process is straightforward and can be completed online through the IRS website. You’ll need basic information about your business, such as its legal name and address.

Securing an EIN not only helps establish credibility but also separates your personal finances from those of your business. This separation is vital when you start applying for loans or credit under the company’s name.

Once you have the EIN, keep it handy; many lenders will require this number before processing any applications related to financing or credit lines. With this essential step completed, you’re well on your way to establishing robust business credit with Brians Club.

Step 3: Brians Club Opening a Business Bank Account

Opening a business bank account is a pivotal step in your journey with Brians Club. It separates your personal finances from your business transactions, establishing professionalism right from the start.

Choose a bank that offers services tailored to small businesses. Consider factors like fees, online banking features, and customer support. A solid relationship with your banker can provide valuable insights later on.

When you visit the bank, bring essential documents: your EIN, operating agreement, and proof of identity. These items demonstrate that you’re serious about managing your business finances responsibly.

Once set up, use this account for all business-related income and expenses. This creates clear financial records which are crucial when applying for credit or loans down the road. Plus, it helps build credibility with lenders as they see consistent activity in dedicated accounts.

Step 4: Brians Club Obtaining Vendor Credit

Establishing vendor credit is a critical step in building your business credit with BriansClub. It allows you to create relationships with suppliers who can help support your operations while boosting your credibility.

Start by identifying vendors that report payment history to the major credit bureaus. These may include office supply companies, wholesalers, or specialized service providers relevant to your industry.

When applying for vendor accounts, be transparent about your business structure and provide any necessary documentation. This could include proof of your EIN or details about your business bank account.

Once approved, make sure to pay on time. Consistent payments will not only strengthen those vendor relationships but also enhance your overall credit profile with Brians Club. Remember, every positive interaction counts towards establishing a solid foundation for future financing opportunities.

Step 5: Building Business Credit with Personal Loans and Brians Club

Building business credit through personal loans requires a strategic approach. Brians Club offers unique opportunities for entrepreneurs looking to enhance their credit profiles.

Using personal loans wisely can jumpstart your business’s financial standing. When you take out a loan, ensure you use the funds specifically for business-related expenses. This demonstrates responsible management and builds trust with lenders.

Brians Club provides access to tailored loan products designed for small businesses. These options often come with flexible terms that align well with various operational needs. By making timely payments, you establish a positive payment history.

Moreover, leveraging personal loans allows you to separate your business and personal finances more effectively. This distinction is crucial as it lays the foundation for building solid business credit over time. As your credit score improves, so do opportunities for larger financing in the future.

How Brians Club Personal Loans Can Help Build Business Credit

Brians Club personal loans offer a strategic way to enhance your business credit profile. By managing these loans responsibly, you can establish a solid payment history that lenders appreciate.

Using Brians Club funds allows for immediate investment in your business needs. Whether it’s inventory, marketing, or technology upgrades, timely payments reflect positively on your credit report.

Moreover, taking out a personal loan through Brians Club can bridge the gap when traditional financing options seem out of reach. It provides flexibility without compromising control over your business decisions.

Additionally, as you build relationships with financial institutions via these loans, they become more inclined to extend credit lines specifically tailored for businesses in the future. This could lead to better terms and lower interest rates down the line.

In essence, leveraging personal loans from Brians Club not only aids immediate growth but also paves the way toward stronger long-term financial credibility.

The Benefits of Using Brians Club

Utilizing Brians Club for building business credit brings a range of advantages. First, it offers streamlined access to financial resources specifically designed for entrepreneurs. This can ease the burden of managing cash flow and facilitate growth opportunities.

Moreover, Brians Club promotes a supportive environment where business owners can connect with like-minded individuals. Networking within this community often leads to valuable partnerships and collaborations that can enhance your business’s visibility and credibility.

Another significant benefit is the potential for lower interest rates on loans compared to traditional lenders. By establishing a solid relationship with Brians Club, you may find more favorable terms that help keep your operational costs down.

Additionally, using personal loans from Brians Club allows you to effectively build your credit profile while still enjoying flexibility in funding options. As you demonstrate responsible repayment behavior, you’ll strengthen both your personal and business credit scores simultaneously.

Leveraging these benefits creates a strong foundation for long-term success in the competitive marketplace. With consistent effort and engagement through Brians Club’s resources, you’re well-equipped to elevate your business journey efficiently.